Smart Tips About How To Avoid Probate In Canada

How to avoid canadian probate the legal procedure of gathering and allocating a deceased person’s assets is known as probate.

How to avoid probate in canada. To prevent assets from becoming a part of your estate and avoid probate in canada, follow the steps below. Advertisement advertisement probate fees differ by province. For example, you don’t want your house to.

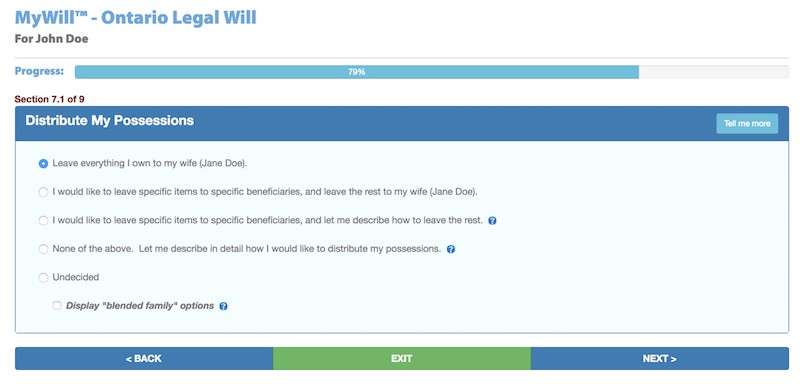

Probate is a fee payable to the provincial government to confirm that a will is valid, and to appoint the executor to administer the estate of the deceased. Designate beneficiaries for retirement plans (rrsps, rrifs, and tfsas) and any life insurance policies. The most common effective planning technique to employ prior to death to minimize probate tax is the use of ‘dual wills’, whereby assets that require probate pass under one will,.

Probate is the legal process of collecting and distributing a person’s assets after his or her death. Many people decide to arrange their estate in. One way to make sure your real property assets pass seamlessly to your heirs would be to place them in a revocable living trust.

Probate can be avoided you can protect your estate, earn more on your money while doing so, and ensure your heirs get their full inheritance in weeks rather than years. Here is a summary of ways to avoid the cost of probate: A living trust saves your heirs money by avoiding probate taxes when you die.

As attorney fees, court costs, probate fees, or taxes can be expensive, many. Strategies to reduce or avoid probate fees depending on the province you live in and the assets you have, it might be worthwhile to look at strategies to reduce or avoid probate fees. Name beneficiaries on your life insurance policies.

It’s not terribly difficult to avoid probate, and you have several options for doing so. The more you prepare, the better off your loved ones will be after your death. The way to do this is to.