Casual Info About How To Reduce Mortgage Interest Rate

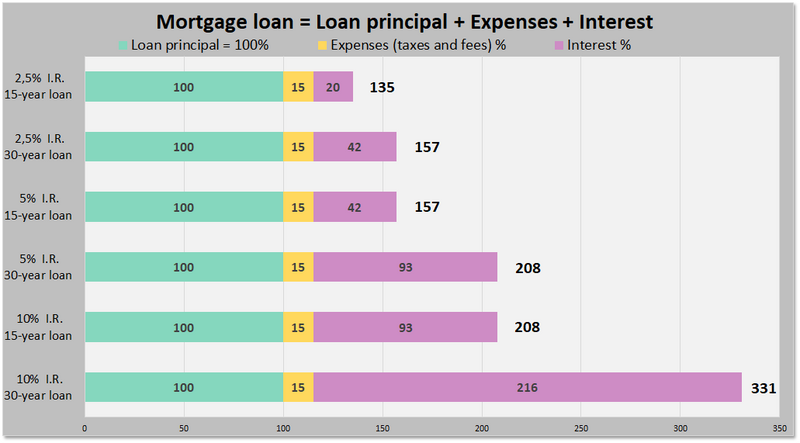

Paying a 25% higher down payment would save you $8,916.08 on interest charges.

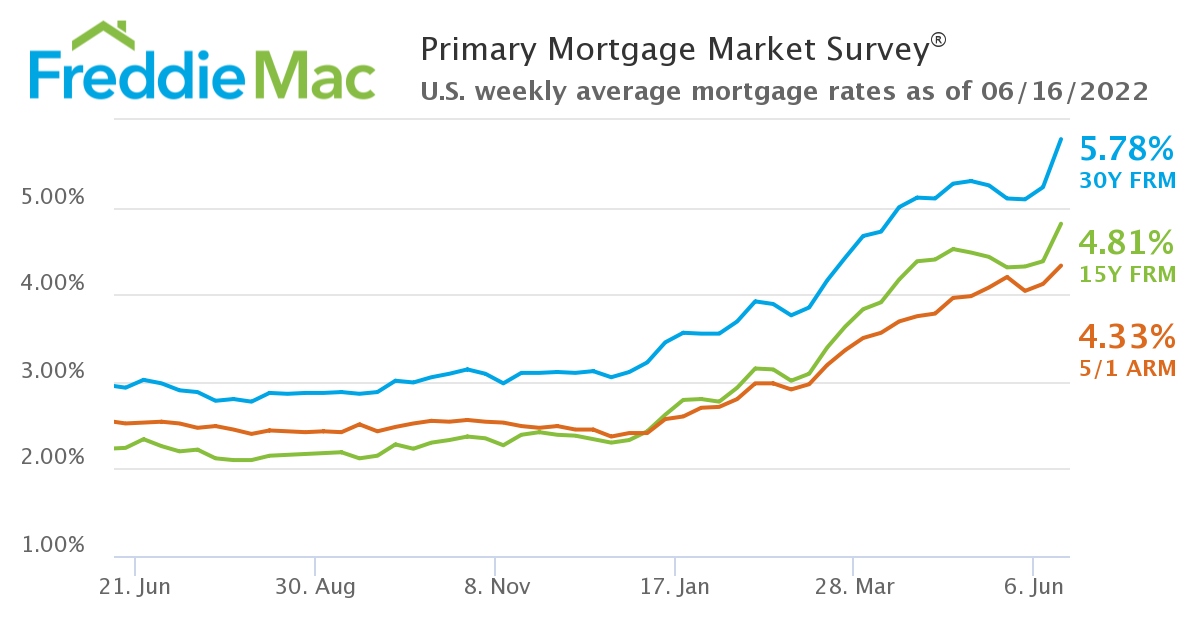

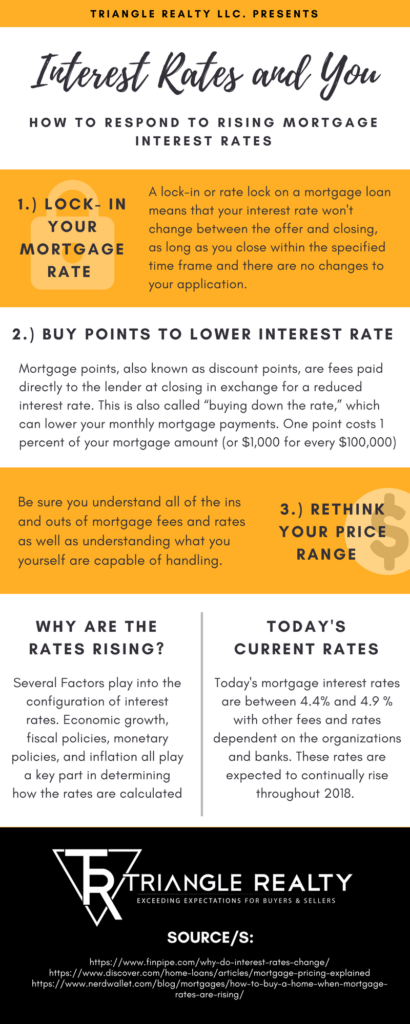

How to reduce mortgage interest rate. Lowering the interest rate by 1% would save you $51,562.03. There are a few simple ideas on how you can lower your mortgage interest rates and pay off as soon as possible. The higher your score, the lower your rate will be.

Refinancing can help you save money and lower your monthly payment if you can qualify for a lower interest rate or a mortgage without pmi. You may also be able to lower. A buydown is a way for a borrower to obtain a lower interest rate by paying discount points at closing.

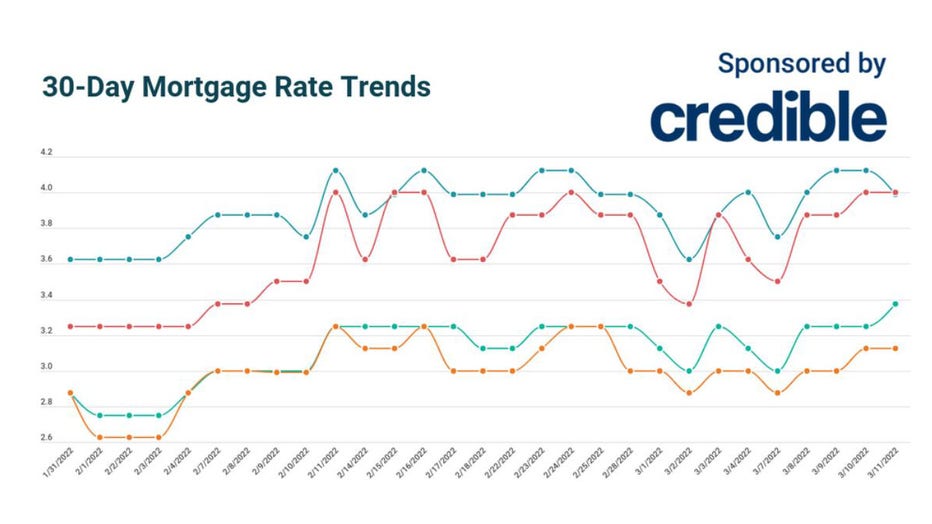

30 year fixed mortgage rates today, lower mortgage interest rate program, lower my mortgage rate, lower interest rate without refinancing, how to lower your mortgage. If you have cash on hand, you can lower your mortgage rate by buying points from the lender. How many times have interest rates gone up?

A mortgage point is typically equal to about. The number one thing you need to do in order to get a better deal on your interest rate is to go mortgage lender shopping. The primary reason homeowners refinance is to lower their mortgage interest.

Just call and request a lower mortgage rate while not conventional or at all common, some folks have obtained lower interest rates. The larger your down payment, the lower your rate tends to be. Discount points, also referred to as mortgage points or prepaid.

You can get a lower mortgage rate by making a larger down payment, reducing your loan term, buying points and keeping your credit in great shape. How to lower your mortgage interest rates #shorts #realestate #investing What are the best ways to have lower interest rates?

:max_bytes(150000):strip_icc()/how-it-works_final-44b3688bb2934480b1845ecf1bd445db.png)

.png)