Breathtaking Tips About How To Increase Return On Equity

Companies can finance themselves with debt and equity capital.

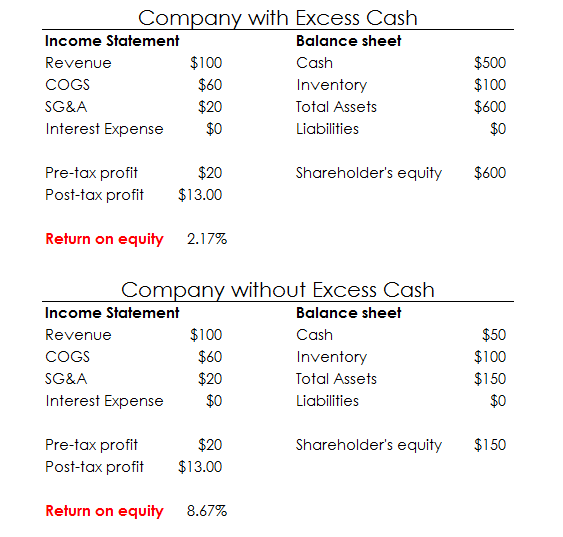

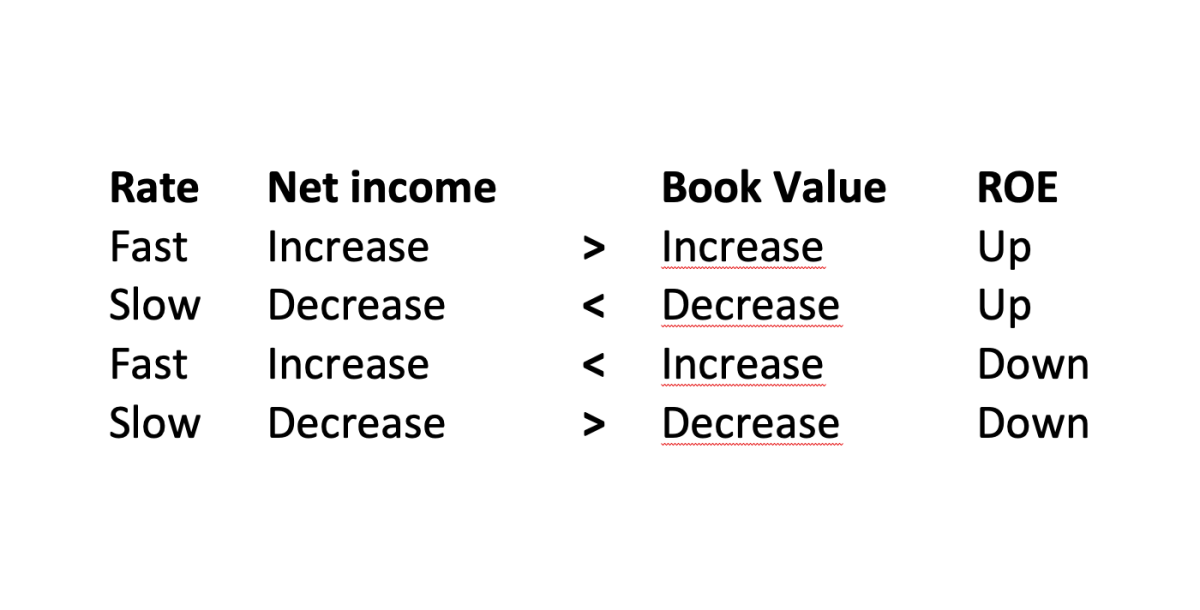

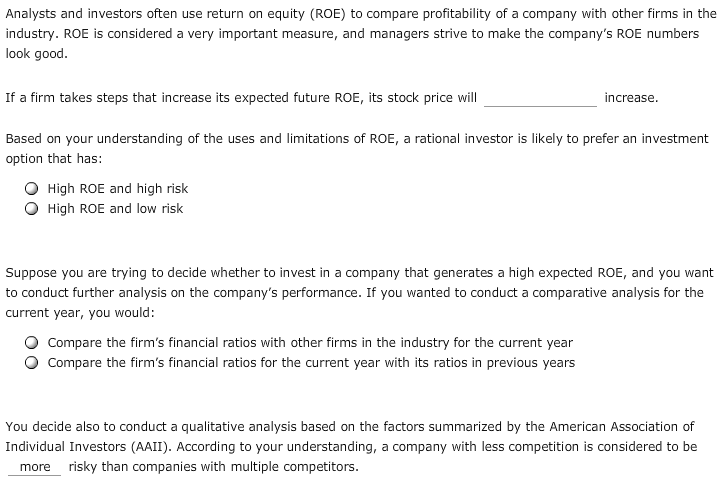

How to increase return on equity. If you’re having a successful strategy, you will be carrying debt. Return on equity = net income / average shareholder’s. Return on equity will increase if the equity is partially replaced by debt.

This is because shareholder equity (roe’s denominator) and debt are connected. The greater the loan number is, the lower the shareholders' equity will be. Companies can finance themselves with debt and equity capital.

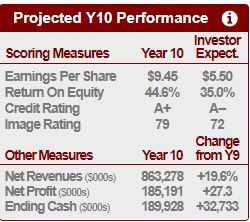

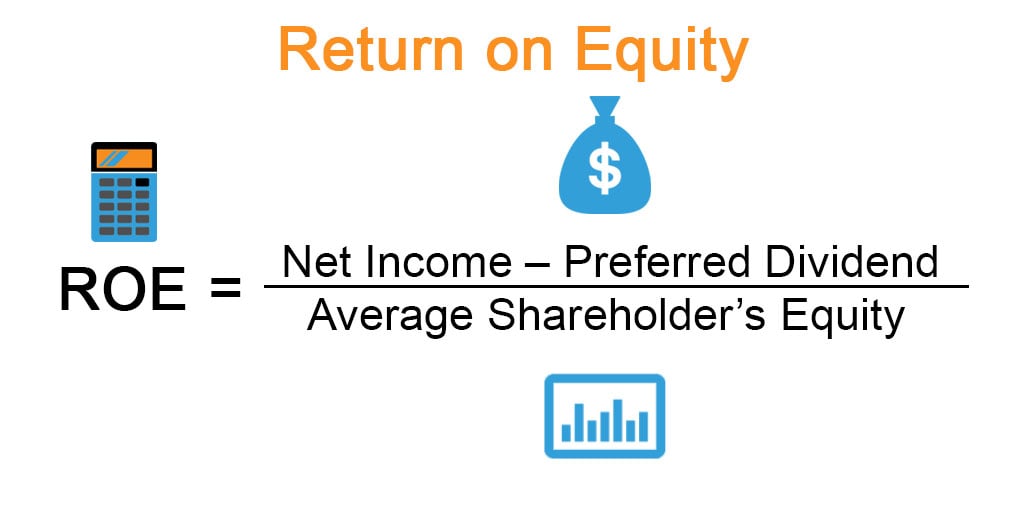

A high return on equity means that the company’s management is more efficient and will produce more growth. Leveraged finance is done with. Often shortened to simply roe, the return on equity measures the net earnings in relation to the total stockholder’s equity.

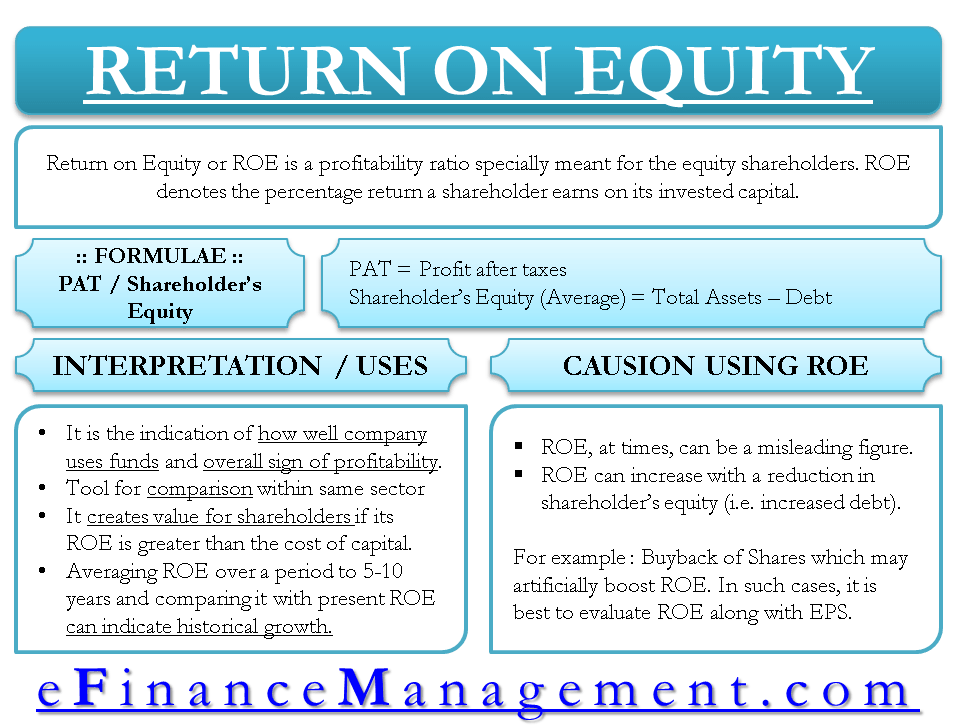

The return on equity of a business entity can be calculated by the following formula: A company can improve its return on equity in a number of ways, but here are the five most common. To improve return on equity, you can optimize revenue and costs or implement certain financial maneuvers.

Improve revenue performance one way to improve return on. If you increase debt, equity decreases. Here's how return on equity works, and five ways a company can increase its return on equity.

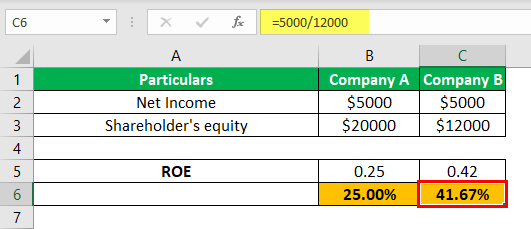

Use more financial leverage companies can finance themselves with. Enter the formula for return on equity =b2/b3 into cell b4 and enter the formula =c2/c3 into cell c4. Some options here would include adjusting your prices,.

:max_bytes(150000):strip_icc():gifv()/returnonequity-v1-1cd72f9606e54be085ea56eb866cc9c4.png)